- May 19, 2016

- Posted by: admin

- Categories: Current News, debt management, Debt Management

MEFMI and the Commonwealth Secretariat (COMSEC) conducted a joint regional workshop on Managing Domestic Debt and Lending Instruments using the Commonwealth Secretariat Debt Recording and Management System (CS-DRMS) from 18 to 27 April 2016 at Crossroads Hotel, Lilongwe, Malawi. The training aimed at imparting theoretical knowledge and practical skills on the management of domestic debt and lending instruments using CS-DRMS version 2.2.

The event was officially opened by the Acting Principal Secretary in the Ministry of Economic Planning & Development in Malawi, Mr. Yona Kamphale.

In his opening remarks, Mr Khamphale commended MEFMI and COMSEC for organizing the training at a time when Governments are increasingly taking recourse to domestic borrowing to finance Government operations amid declining external concessional financing.

The Director of the Debt Management Programme at MEFMI, Mr. Raphael Otieno highlighted that MEFMI is paying attention to the growing domestic debt in the region, and hence the Institute is intensifying capacity building activities in this regard. He cautioned member countries against the current heavy issuance of sovereign bonds in the international capital markets. He pointed out that the current trends are likely to compromise debt sustainability in the region.

Speaking on behalf of COMSEC, Mr. Madhav Sharma, noted with gratification the increasing use of the CS-DRMS in managing public debt in the region. Mr. Sharma also hailed the existing partnership between the MEFMI and CoMSEC.

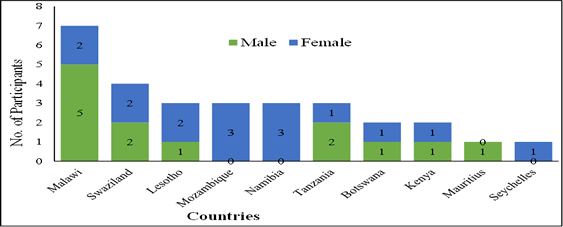

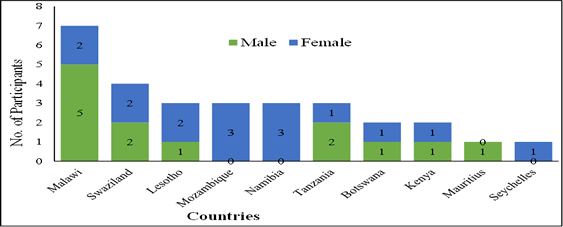

The workshop drew junior to middle level staff responsible for managing domestic debt and lending agreements in the Ministries of Finance and Planning, and Central Banks. A total of 29 officials from ten (10) CS-DRMS user countries, including eight (8) MEFMI member states and two (2) non-member states participated in the workshop.

The workshop was facilitated by five (5) resource persons, including two (2) from COMSEC, one (1) regional expert, one (1) MEFMI Fellow and one (1) staff.

The workshop was delivered through a combination of PowerPoint presentations and hands-on exercises and case studies. The presentations covered basic concepts on domestic debt and lending instruments. The practical sessions involved going through the different features of CS-DRSMS that are used for managing domestic debt and lending instruments. These included recording, instruments management, database validation, different ways of extracting debt reports from the CS-DRMS database, and data exports. Participants from Kenya and Mozambique shared their country experiences on managing domestic debt and lending instruments, respectively, with emphasis on the processes and tools used.