- October 30, 2017

- Posted by: admin

- Category: Debt Management

Sound practice requires that Governments develop and implement debt management strategies in order to minimise the cost and risks associated with their debt portfolios and alternative financing options. In order to strengthen the capacity of debt management officials in MEFMI member countries on debt management strategy formulation and implementation and in response to the changing financing environment, MEFMI conducted a regional workshop on Sovereign Liabilities Risk Analysis and Debt Management Strategy Formulation from 24 July to 2 August 2017 at Phakalane Golf Estate Hotel Resort in Gaborone, Botswana.

The objectives of the workshop were:

• To introduce participants to IMF/World Bank Medium Term Debt Management Strategy (MTDS) analytical tool for designing debt management strategies;

• To impart practical knowledge and skills on debt strategy formulation and implementation

The workshop was officially opened by the Senior Policy Advisor in the Ministry of Finance and Development Planning in Botswana, Dr. Wilfred Mandlebe. In his remarks, Dr. Mandlebe said that the workshop was organized at an opportune time when the financing landscape facing developing countries, including those in the MEFMI region, had changed considerably over the past decade. This is reflected by the significant decline in the cheaper external concessional financing available to developing countries, particularly after the global economic financial crisis. He said that there has been a change in the areas of support by traditional lenders and donors who are increasingly paying attention and committing more resources to other global issues such as climate change and disaster prevention.

In this regard, Dr. Mandlebe said that most governments in developing countries have increasingly taken recourse to other sources of financing such as semi-concessional loans and international sovereign bonds, noting that four (4) MEFMI member countries had already tapped on the international capital market. He noted with concern that the change in the financing landscape presents new cost and risks for governments’ budgets. For example, the semi-concessional and sovereign bonds attract high interest rates while their maturities are much shorter than the traditional financing instruments, leading to high cost of debt service.

Dr. Mandlebe also cited the case of Botswana which had contracted a significant external loan in 2009 in order to finance its budget and cushion the country’s foreign exchange reserves in response to the global financial crisis. He said that this resulted in a significant increase in the country’s debt to GDP ratio from 6.5% in 2008/09FY to 26.8% in 2010/11FY before subsiding to the current level of 23.3% in 2016/17FY. These developments led the Ministry of Finance in Botswana to formulate the country’s first Medium Term Debt Management in 2016 whose main goal is to achieve debt sustainability as part of the country’s fiscal rules. He therefore commended MEFMI, the World Bank and IMF for organising the workshop, indicating that it was critical for enhancing the capacities of member countries to design effective debt management policies and strategies. He also urged governments in the MEFMI region to develop and implement medium term debt management strategies in order to benefit from the alternative financing options while also managing the associated costs and risks.

Speaking on behalf of MEFMI, the then Acting Director of the Debt Management Programme, Mr. Stanislas Nkhata, highlighted the worrying trend in debt levels in the region, particularly in MEFMI member countries that had previously benefitted from the Heavily Indebted Poor Countries Initiative (HIPIC). He emphasised the need for debt management offices to build capacity in cost and risk analysis to avoid episodes of debt distress in the future.

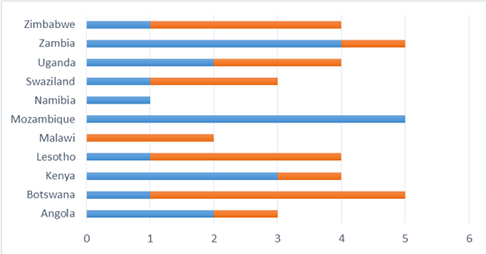

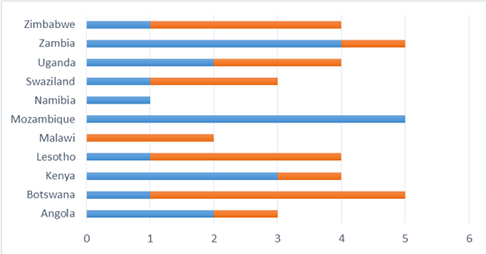

The workshop targeted middle level officials responsible for middle and front office functions of debt management in Ministries of Finance and Economic Planning as well as from Central Banks. 40 Participants from eleven (11) MEFMI member countries attended the workshop. 21 were female, representing 53 percent of the total.

The workshop was facilitated by four (4) resource persons, namely: Ms. Sandra Hlivnjak (World Bank), Mr. Arindam Roy (IMF Consultant), and two (2) MEFMI staff (Mr. Stanislas Nkhata and Ms. Josephine Tito).

The workshop was delivered through a combination of PowerPoint presentations as well as practical exercises. The topics covered included:

• Current trends and key issues in public debt management.

• Introduction to the MTDS Analytical Tool.

• The MTDS 8-Step process (covering areas such as identifying the medium term strategic objectives and scope for debt management, identifying funding sources, and assessing the costs and risks associated with alternative borrowing strategies).

• Excel functions for aggregating debt data used in the MTDS analytical tool.

• Role of a quantitative tool in developing a debt management strategy.

• Overview of the MTDS Analytical Tool.

• Designing debt management strategic benchmarks public debt strategy formulation.

• Implementing a debt management strategy.

There were also presentations by participants from Kenya, Uganda and Zimbabwe aimed at sharing experiences on debt strategy formulation, highlighting challenges and key success factors.

Participants also had a group case study on formulating a medium term debt management strategy. This aimed at ensuring that participants had clear understanding and practical skills of designing a debt management strategy based on the concepts covered during the workshop.