- October 30, 2017

- Posted by: admin

- Category: Debt Management

The need to achieve and maintain sustainable levels of public debt remains the main objective of most governments in developing countries as the development financing landscape continues to evolve. The past decade has seen a significant change in the financing environment, characterised by the decline in concessional sources of funding and an increase in non-concessional sources as well increased reliance on domestic debt markets.

These developments necessitate the need to build capacity within debt management offices and related institutions within the MEFMI region to enhance their knowledge of these complex and dynamic issues in public debt management. In order to address the high staff turnover and capacity gaps within debt management institutions in member countries, as well as efforts to widen the pool of skilled and knowledgeable officials in the area of public debt management, MEFMI offered an E-Learning course on Foundations of Public Debt Management from 5 June to 14 July 2017.

The objective of the course was to introduce participants to the key tenants of public debt management by providing a clear understanding of the fundamentals of public debt management.

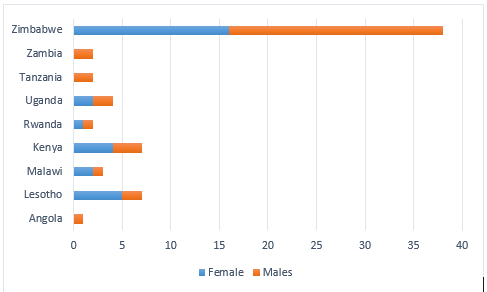

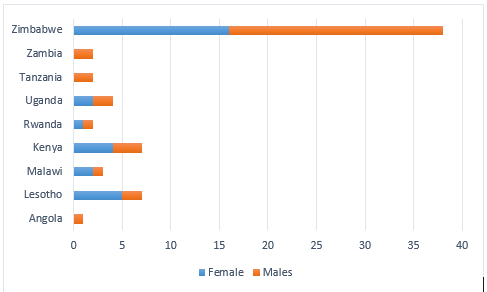

A total of 81 officials were nominated for the Course from nine (9) MEFMI member countries, namely: Angola, Lesotho, Malawi, Kenya, Rwanda, Uganda, Tanzania, Zambia and Zimbabwe. These were drawn from the offices responsible for debt management and related functions within the Ministries of Finance and Economic Planning, Central Banks and Auditor General’s Offices. However, 66 participants logged into the MEFMI E-Learning portal and attempted at least one of the six (6) Modules of the course, of which 47 percent were female and 53 percent were male. Of these, 57 participants successfully completed all the modules and quizzes, representing a completion rate of 86%.

Fig 1: Participation by country and gender

The course was facilitated by two (2) mentors, Mr. Cappitus Chironga, a MEFMI Accredited Fellow of the Central Bank of Kenya, and Mr. Nardeo Useree, an independent consultant from the United Kingdom. The learning environment was enhanced by the active participation of these mentors who responded quickly to the issues raised by participants as well as providing guidance on the course topics. Their vast experience in debt management was beneficial to the participants.

The course was offered for a period of six (6) weeks, covering the following core areas in a weekly modular form:

- Introduction to public debt management: covered definitions and concepts in public debt management, rationale for borrowing as well as classifications of public debt;

- External Debt Management: covered the definition of external debt as well as sources of external debt, including multilateral, bilateral and commercial creditors;

- Domestic debt management: covered definitions of and concepts in domestic debt management. It also covered calculations and pricing of domestic instruments;

- Debt Restructuring: the module aimed to enhance the knowledge of participants on the rationale, types and the key players in debt restructuring;

- Introduction to debt sustainability analysis and medium term debt management strategy: The module sought to present frameworks for conducting public debt sustainability analysis in the Low Income and Market Access Countries as a basis for designing medium term debt management strategies.

- Legal and institutional arrangements for public debt management: The module aimed at equipping participants with knowledge on the sound practices regarding institutional set up of public debt management offices. It also highlighted the key elements of an effective legal framework for public debt management as provided in the Debt Management Performance Assessment (DeMPA) framework developed by the World Bank.

Participants were required to complete each module within a week with an option of going through the online lessons or downloading the Module in the PDF format which they could read at a convenient time. This latter option provides a flexible learning environment especially to participants who do not have continuous access to internet. Each Module had a Quiz, which the participants were required to complete, with the objective of assessing their understanding of issues covered in the module. The pass mark for the quizzes was 80%.

Furthermore, participants were required to participate in the Discussion Forum by sharing their views and country experiences on the issues covered in the Module. Some of the topics covered in the Discussion Fora included the following:

- Merits and demerits of public debt;

- Role of primary dealers in domestic debt market development in the MEFMI Region;

- Role of debt relief initiatives such as the Heavily Indebted Poor Countries (HIPC) Initiative and the Multilateral Debt Relief Initiative (MDRI in ensuring debt sustainability in developing countries;

- The cost and risks associated with public debt in developing countries and the mitigating strategies;

- Appropriate location of a debt management office. i.e. Should it be autonomous or located in the Ministry of Finance or Central Bank?

- Comprehensiveness of legal frameworks for public debt management in the MEFMI member countries in terms of whether they cover all the elements for effective debt management.

There was active participation on the discussion forum, with participants sharing rich country experiences and insights on the issues under discussion.

The Debt Management Programme intends to offer this course again in 2018 and will update the Course Modules in line with the new developments in public debt management. In addition, the Programme will work with other MEFMI Programmes in adopting innovative IT solutions to improve interaction on the E-learning platform, including offering future courses through video conferencing.