- October 30, 2017

- Posted by: admin

- Category: Debt Management

Governments require comprehensive, reliable and up-to-date public debt information to inform policy decisions, strategy formulation and keep stakeholders abreast of debt developments. Since 2011, the Ministry of Finance and Economic Development in Zimbabwe has made significant progress in building and strengthening public debt management capacity. This includes setting up a dedicated Public Debt Management Office (PDMO), adoption of a modern legislation on debt management, preparation of debt management procedure manuals, installation of public debt data back-ups and disaster recovery site, as well as staff recruitment and training.

The Public Debt Management Act, promulgated in 2015, provides a comprehensive framework for public debt management, and clearly specifies the functions of the PDMO. These functions include maintaining accurate records of outstanding public debt, guaranteed and on-lending loans in a computerized database, and regularly validating and reconciling the public debt database. Since its establishment in 2010, the PDMO has prioritized maintenance of a complete and accurate public debt database. In 2014, a joint IMF and World Bank mission conducted a reconciliation exercise of Zimbabwe’s public and publicly guaranteed external debt owed to multilateral, bilateral, and commercial creditors. The exercise verified the debt data records in the DMFAS against information received from creditors. Considerable discrepancies were identified and corrected. A subsequent joint MEFMI/World Bank/IMF debt management performance assessment (DeMPA) conducted in December 2015 identified additional discrepancies in the database that needed to be corrected.

As part of efforts to ensure completeness, accuracy and consistency of its debt database, the Government of Zimbabwe, through the Ministry of Finance and Economic Development, requested the MEFMI Secretariat and UNCTAD for technical assistance in conducting a debt database validation exercise and training staff on data validation using DMFAS. In response, a joint MEFMI/UNCTAD mission conducted a debt data validation and training mission from 17 to 28 July 2017 at Kadoma Hotel and Conference Centre in Kadoma, Zimbabwe.

The primary objective of the mission was to validate Zimbabwe’s public domestic and external debt data. Specific objectives were to:

• Validate public and publicly guaranteed debt database maintained in the DMFAS;

• Develop a debt data validation calendar and checklist for Zimbabwe which would be executed by the debt management office to ensure reliability of data;

• Enhance participants’ capacity to undertake formalized debt data quality assessments using standard operational reports in the DMFAS.

The workshop was officially opened by the Director of the Back Office in the PDMO, Mrs Lindiwe Tirivanhu, on behalf of the Head of PDMO, Mr. John Mafararikwa. In her remarks, Mrs Tirivanhu thanked MEFMI and UNCTAD for accepting the Ministry’s invitation to provide technical assistance to the Government of Zimbabwe. She reiterated the importance of data validation in the public debt management process, noting that a validated database ensures accurate and reliable public-sector debt statistics, which are critical for formulating debt management policies and strategies while also enhancing credibility in the management of public debt.

In his remarks, the Programme Manager in the Debt Management Programme at MEFMI, Mr. Tiviniton Makuve, emphasised the need for the PDMO to regularly undertake formalized assessments of the debt database, based on documented procedures and guidelines in order to reduce operational errors and preserve institutional memory even when staff turnover is high. He reiterated the importance of regular and proper validation of all debt information recorded in the DMFAS before internal and external dissemination.

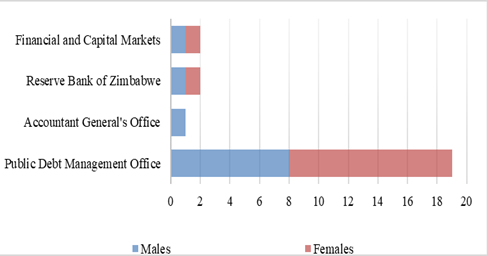

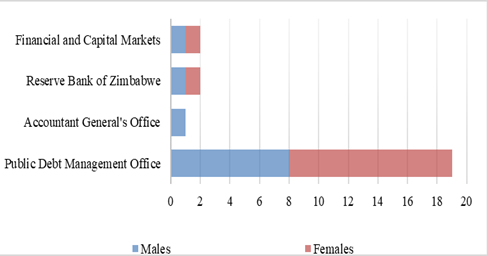

The workshop targeted officials in relevant departments of the Ministry of Finance and Economic Development and the Reserve Bank of Zimbabwe, particularly those involved in recording debt data in the DMFAS as well as those responsible for generating reports from the system. It was attended by 24 officials, of which 13 or 54 percent were females and eleven (11) or 46 percent were male from the following departments: Accountant-General’s Office; Public Debt Management Office; Financial and Capital markets; and Reserve Bank of Zimbabwe.

The diversity in the background of participants enriched discussions, which made the event very informative and successful.

The mission team comprised Mr. Khaled Ibrahim Mohamed of UNCTAD in Geneva; Mr. Tiviniton Makuve of the MEFMI Secretariat; Ms. Susan Nattembo, a MEFMI Fellow from the Bank of Uganda; and Mr. Tongai Tarubona, a MEFMI Trained-Trainer of the Reserve Bank of Zimbabwe.

The mission combined lectures, participants’ presentations and actual validation of the debt database in the DMFAS. The validation exercise helped to reinforce concepts and methodologies covered during lectures. Priority debt database validation checks were identified, and the frequency for each check was determined.

The following topics were covered:

• Data validation and international initiatives;

• Data validation process;

• Data validation and audit;

• Data validation and operational risk management;

• Validation checks for general administration, loans, debt securities, on-lent loans, reference files and system parameters, security and auditing;

• Use of the DMFAS 6 pre-defined 18 validation queries;

• Use of DMFAS 6 Query Tool to create simple validation query and simple reports;

• Advanced usage of the Query Tool in the Validation Process; and

• Analysis (average terms; grant element; debt ratios; sensitivity analysis)

The following debt management records were validated:

• General administrative checks;

• Validation of loans: (agreements; disbursements; and debt service);

• Validation of debt securities (issuances; subscriptions; and debt service);

• On-lent loans (agreement; disbursements; and debt service); and

• Validation of non-debt data (reference files – exchange rates and interest rates);

The DMFAS “live” database for Zimbabwe was used for practical validation, with a very high level of caution to avoid loss of information.