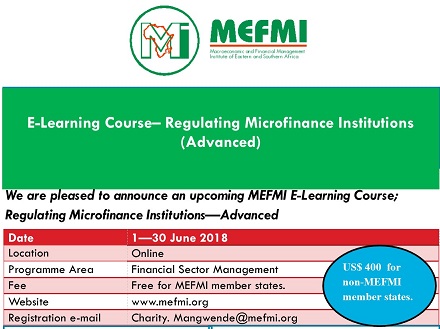

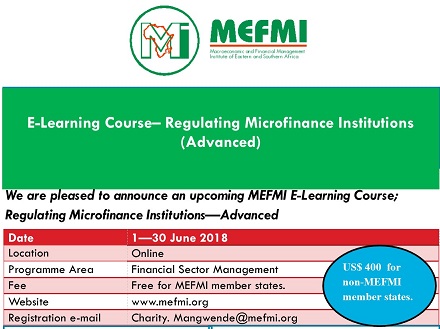

- March 5, 2018

- Posted by: admin

- Category: Financial Sector Management

Background

Background

Sub-Saharan Africa (SSA) has the lowest level of access to finance of any region in the world, with an average banked population of only 24 percent (Findex 2012). The region’s banking systems are small in both absolute and relative size, and the microfinance sector has been relatively slow to expand in SSA compared to other regions in the world. This has seen MEFMI member countries aggressively employing a range of strategies for extending the reach of microfinance, including the transformation of existing institutions, the creation of stand-alone greenfield microfinance institutions (MFIs) with and without a centralized management or holding structure, to encourage growth of the sector.

As the microfinance sector is poised for growth, it is also important for financial sector regulators and supervisors to upgrade their regulatory and supervisory skills in this area to be able to effectively support its growth and impact in economic growth.

This e-learning workshop is a follow up to the Fundamentals of Regulating Microfinance workshop which MEFMI ran in 2016.